We will continue our efforts to make HDB flats more affordable, and enable parents and children buying new flats to live with or near one another.

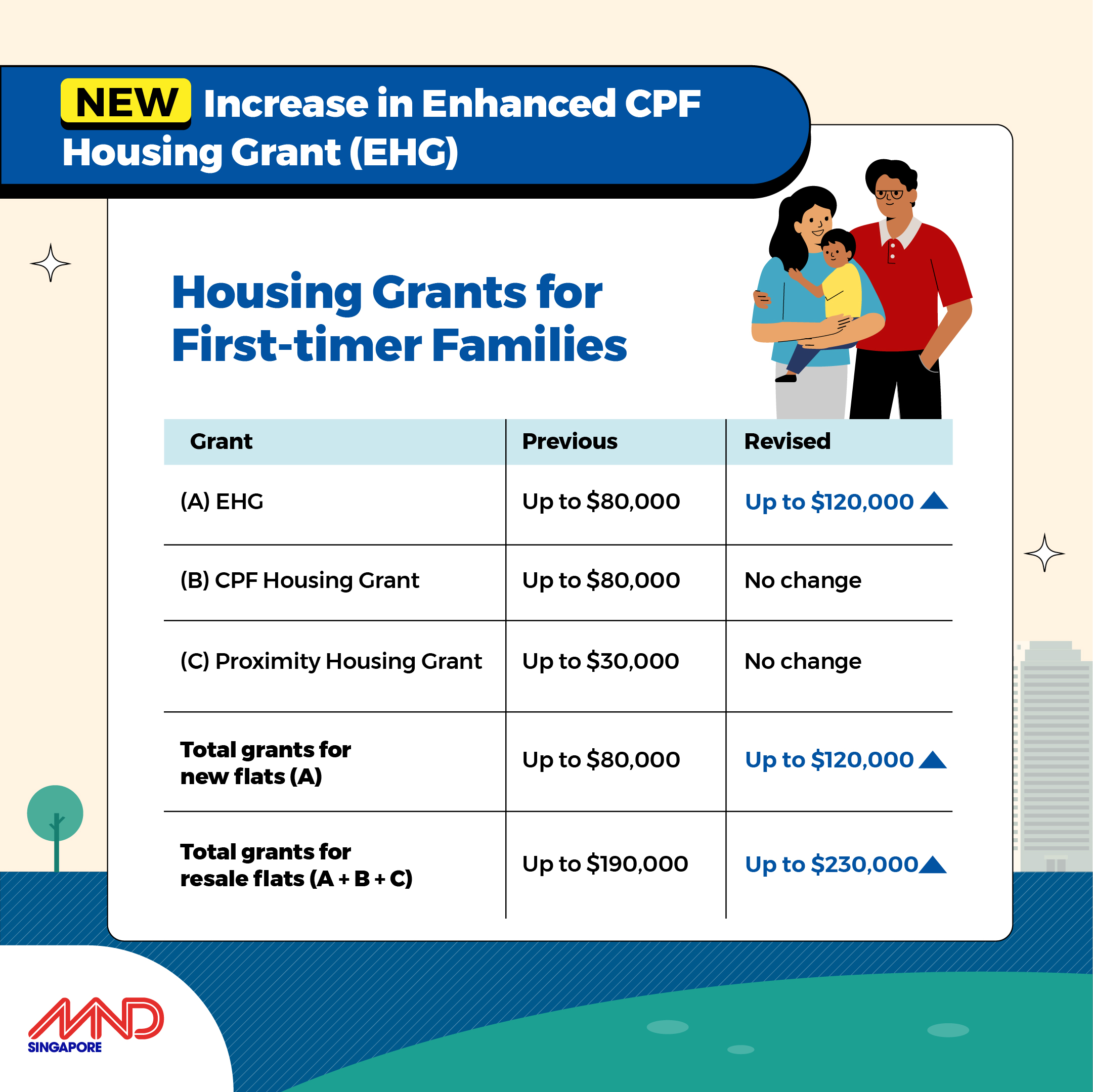

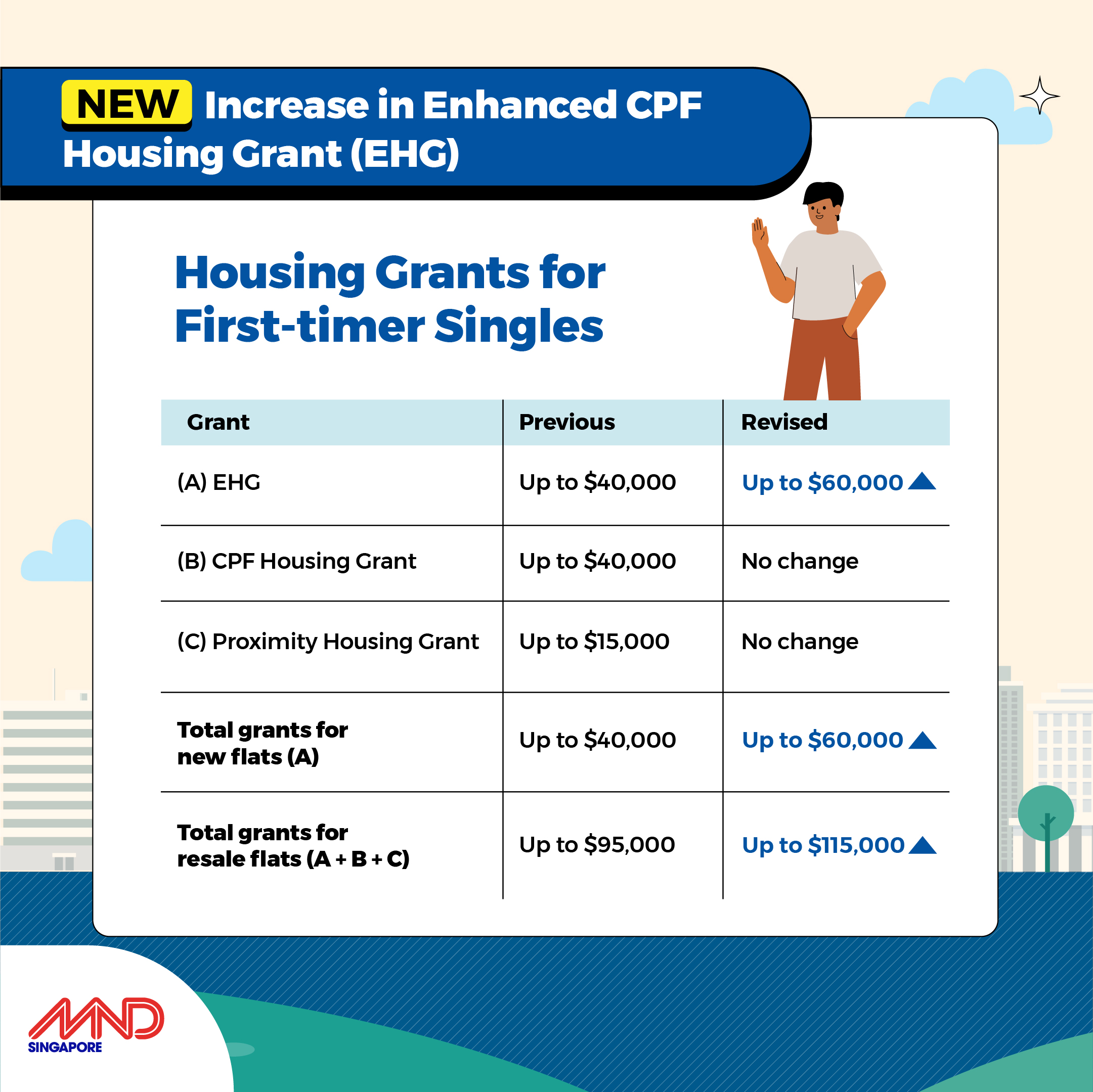

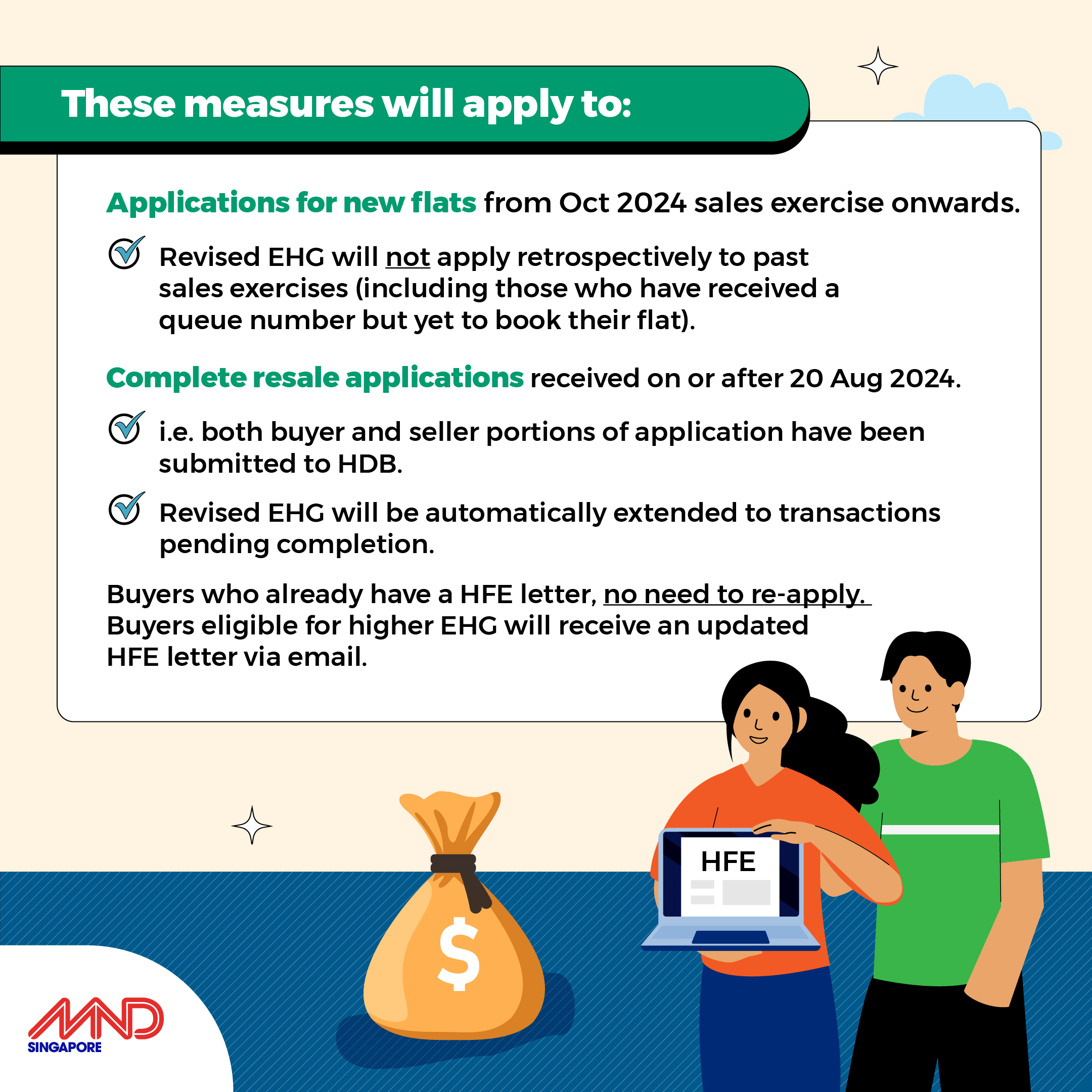

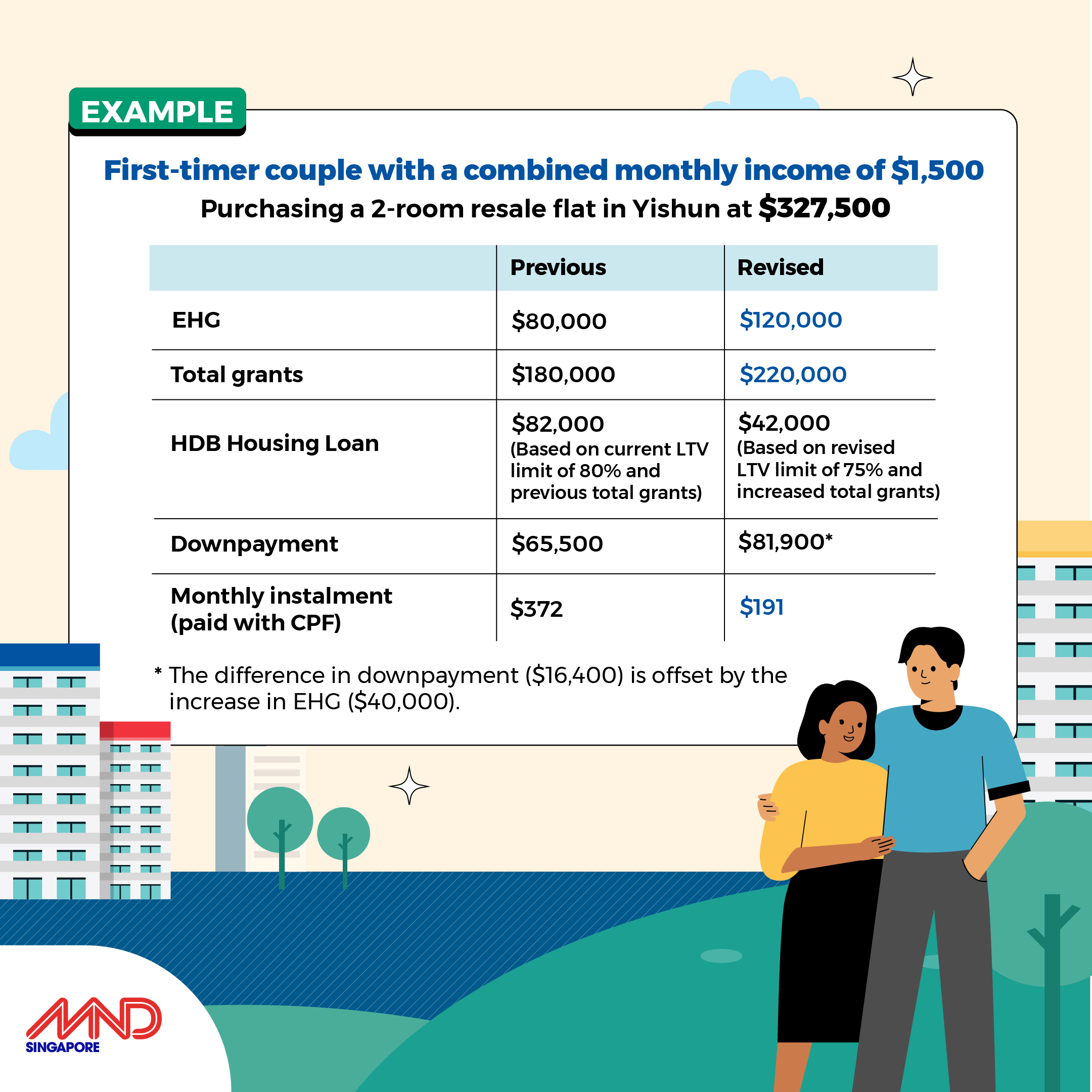

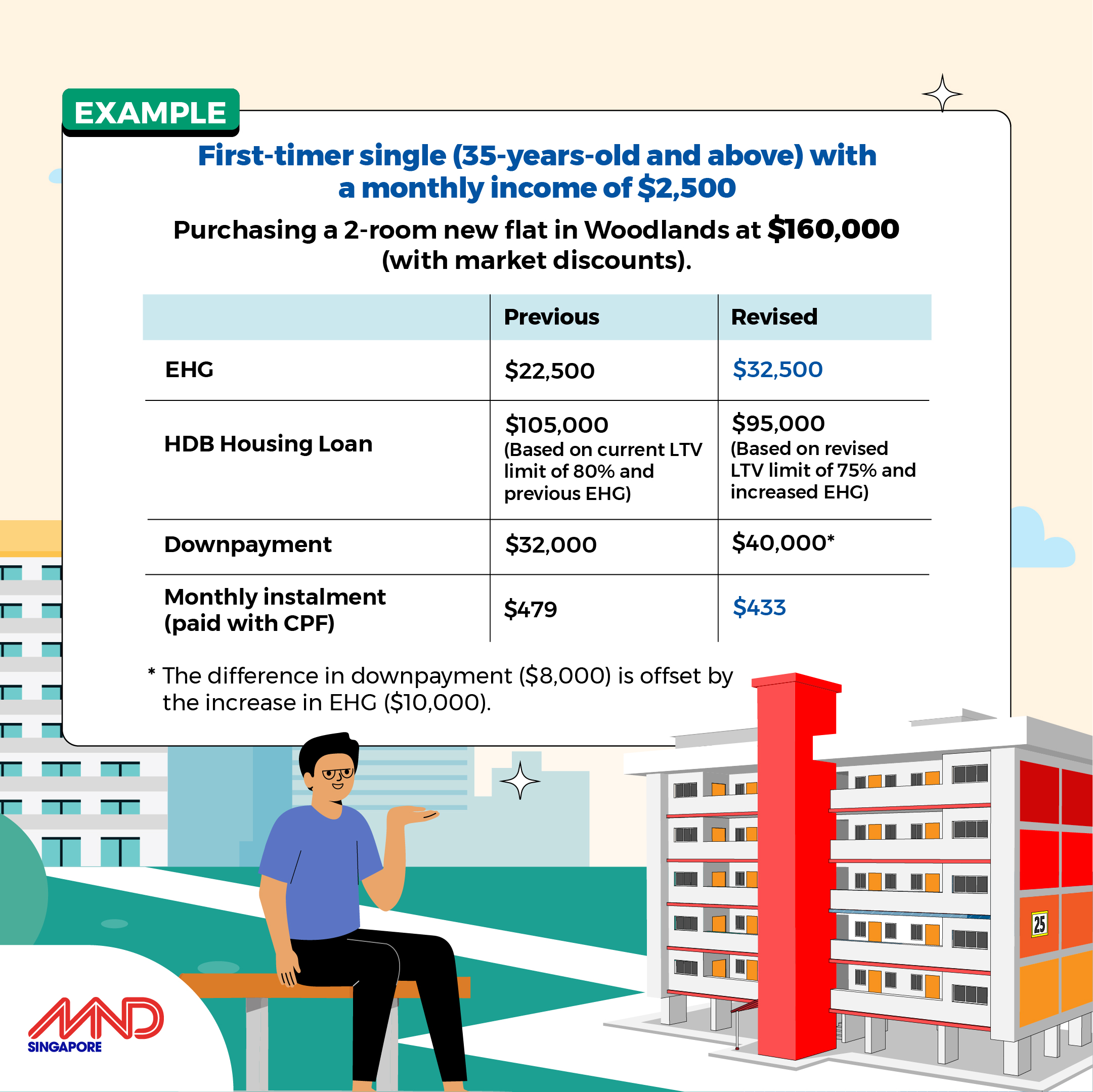

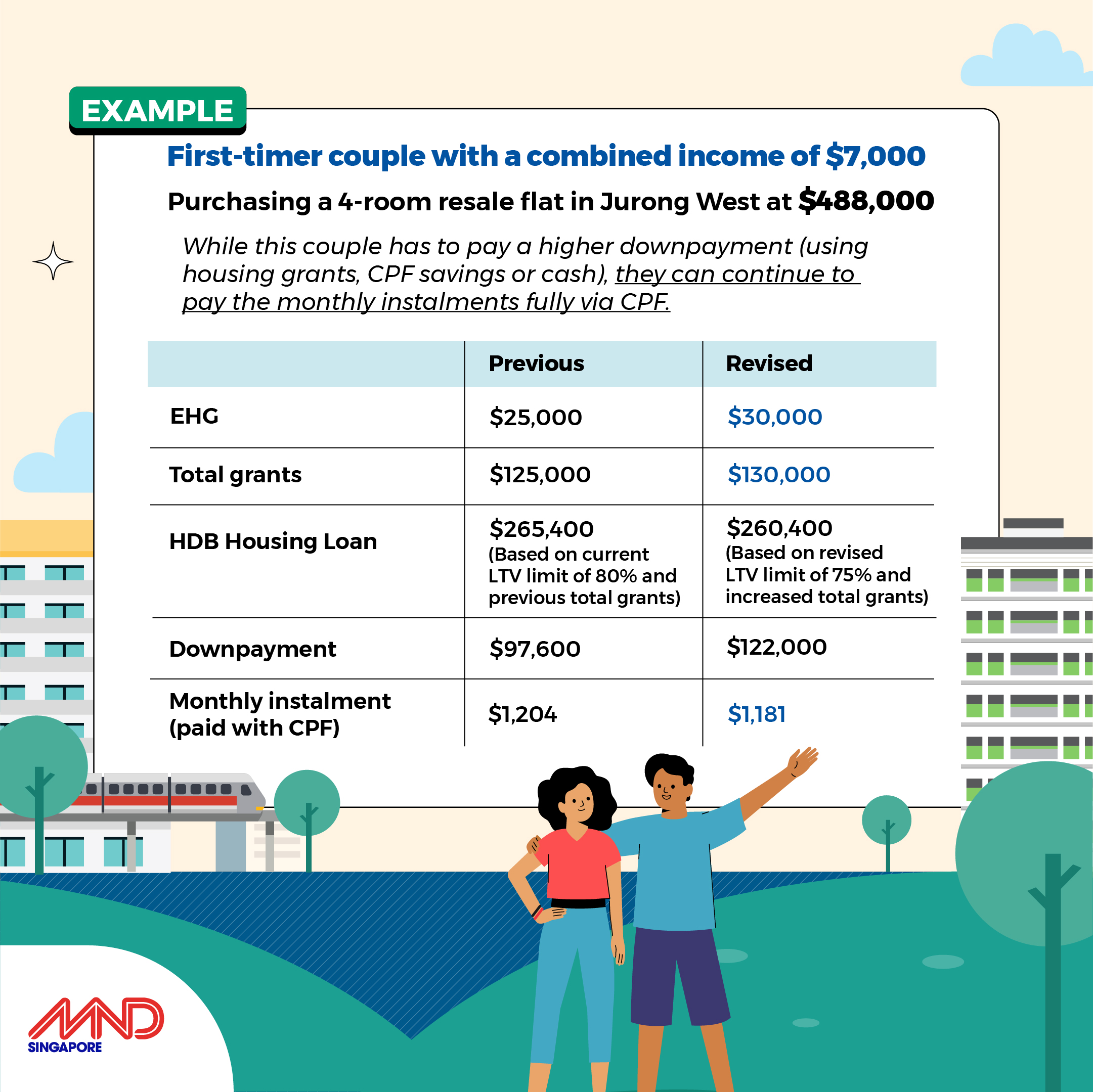

To provide extra support for lower-income buyers to get their first home, we will increase the Enhanced CPF Housing Grant quantum for both new and resale flats to support first-time home buyers.

Besides affordability, we also want to make it easier for families to look after one another. Currently, we provide priority access to married children and their parents buying new HDB flats to live with or near one another. From mid-2025, we will extend priority access to all parents and their children – married or single.

The Loan-to-Value (LTV) limit for HDB loans has also been lowered from 80% to 75%. This brings the LTV limit for HDB loans in line with loans granted by financial institutions, which remains at 75%. Given the sustained, strong, broad-based demand for HDB resale flats, these measures will help cool the market and encourage prudent borrowing, thus making housing more affordable for lower-to-middle income first-time home buyers.

We will continue to monitor the property market closely and adjust policies as necessary to foster a stable and sustainable property market.

For the Joint MND-HDB Press Release, click here.

Measures to Cool the HDB Resale Market and Provide More Support for First-Time Home Buyers

For the One-Pager Infographic, click: ( English 289 KB, 中文 287 KB, Bahasa Melayu 334 KB, தமிழ் 1,126 KB)