Providing More Support for Home Buyers and Public Rental Families

Mar 5, 2025

More help for flat buyers and public rental families with young children to purchase an HDB flat

At MND’s Committee of Supply debate today, Minister for National Development, Mr Desmond Lee, and Minister of State for National Development Associate Professor Muhammad Faishal Ibrahim, announced several measures to enhance public housing accessibility and strengthen support for public rental families with children in their journey towards achieving home ownership.

For Flat Buyers [announced by Minister Desmond Lee] | Helping young families secure their first home - Strong pipeline of flat supply, including in new housing areas such as Mount Pleasant later this year

- HDB will hold another Sale of Balance Flats (SBF) exercise later this year

|

For Rental Families [announced by MOS Faishal Ibrahim] | Supporting public rental families with children to achieve home ownership through the Fresh Start Housing Scheme - Increase Fresh Start Housing Grant from $50,000 to $75,000 for second-timer (ST) public rental families with children

[Date of implementation: July 2025 BTO exercise] - Extend Fresh Start Housing Scheme to first-timer (FT) public rental families with children:

- They can buy a 2-room Flexi or 3-room Standard flat on a shorter lease, and receive the Enhanced CPF Housing Grant (EHG) of up to $120,000.

[Date of implementation: First BTO exercise in 2026] |

Enhancing Housing Accessibility for Flat Buyers

Strong Pipeline of Flat Supply

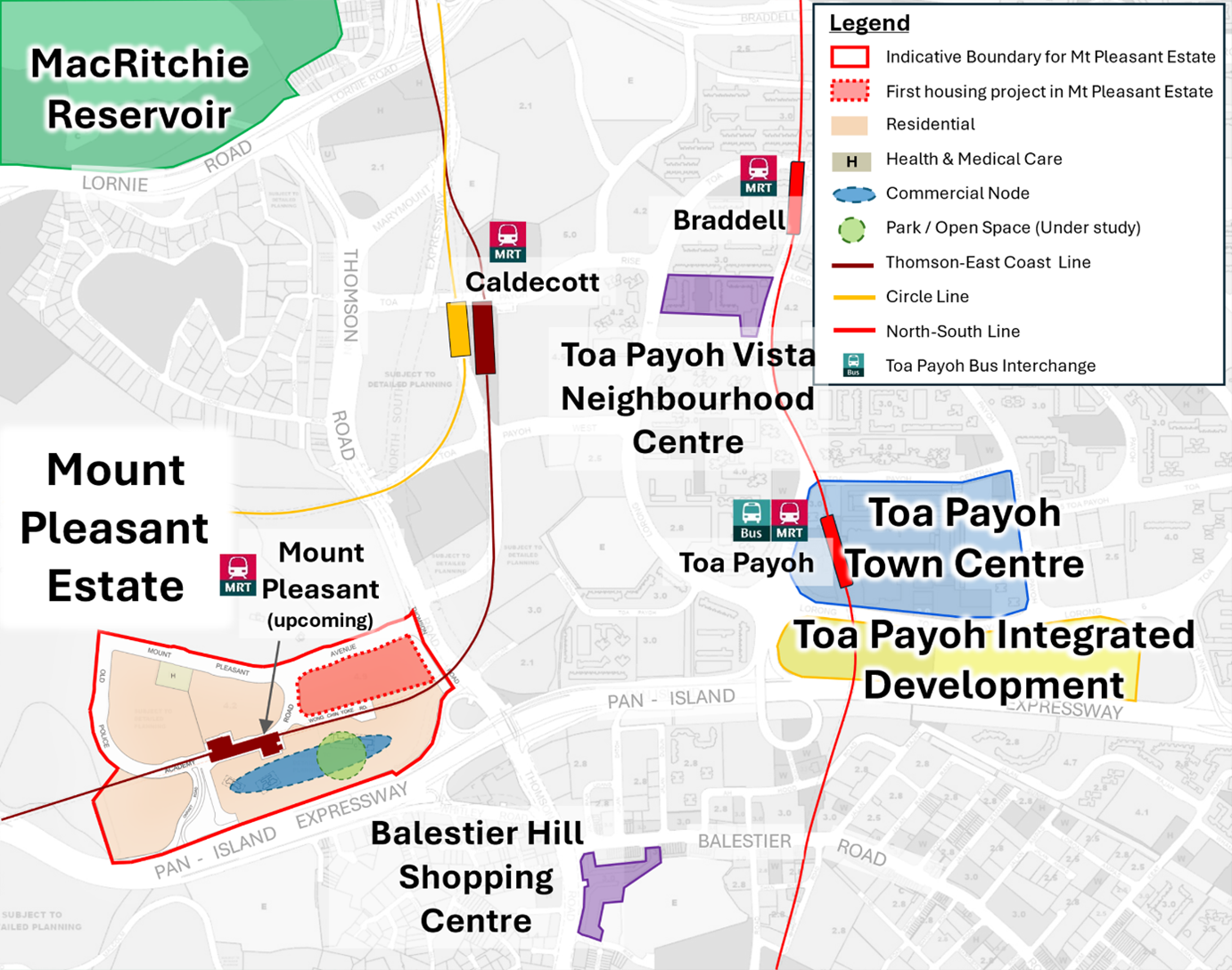

HDB will continue to roll out a strong supply of flats in the next few years to meet demand, with more than 50,000 Build-to-Order (BTO) flats to be launched from 2025 to 2027. In total, HDB will launch about 130,000 flats from 2021 to 2027, increasing public housing stock by 11%. This includes a good mix of Standard, Plus and Prime BTO flats in various locations across existing estates as well as new housing areas. A higher proportion of new flats over the next few years will be Shorter Waiting Time (SWT) flats, with waiting time of less than 3 years. This includes about 3,800 SWT flats or about 20% of the 19,600 BTO flats to be launched this year. Home buyers can look forward to BTO projects in various attractive locations such as Mount Pleasant, where the first of six public housing projects will be launched later this year.

Location of the upcoming Mount Pleasant housing estate

First BTO Project at Mount Pleasant

The first BTO project at Mount Pleasant, consisting of approximately 1,500 dwelling units of 2- to 4-room flats as well as public rental flats, will be launched in the October 2025 BTO exercise. There will be residential blocks exceeding 40 storeys, with facilities such as an eating house, supermarket and shops located within the precinct for residents’ convenience. This project is conveniently located near the Mount Pleasant MRT station on the Thomson-East Coast Line, which will open in tandem with the completion of the public housing developments in Mount Pleasant. Situated near the iconic MacRitchie Reservoir – Singapore's oldest reservoir and a significant part of the Central Catchment Nature Reserve – the project will offer future residents with easy access to lush green spaces, recreational activities and a tranquil nature retreat within the city to relax and unwind. Mount Pleasant will also offer a range of modern conveniences for residents. Residents will also benefit from the future Toa Payoh Integrated Development which will include shops offering daily necessities as well as a community amenities such as a polyclinic, library, town park and sports facilities.

Over the next few years, HDB will progressively develop the 33-hectare estate into a new housing area, which will yield approximately 5,000 new homes when fully completed. These plans are part of a broader strategy to enhance the geographical distribution of public housing and cater to the evolving aspirations and diverse needs of Singaporeans, including young families who wish to live near their parents.

The design of the new Mount Pleasant estate, including its housing developments, will sensitively incorporate the area’s rich heritage, with selected elements and buildings being conserved, integrated, or repurposed. More information on the development plans for Mount Pleasant will be provided when ready.

Artist’s impression of the first housing project in Mount Pleasant, to be launched in October 2025.

Artist’s impression of a new building at Mount Pleasant estate, with its design drawing inspiration from the area’s heritage

Supporting Public Rental Tenants in Realising Their Home Ownership Aspirations

The Fresh Start Housing Scheme was introduced in 2016, to help ST families with children staying in public rental flats buy a 2-room Flexi or 3-room Standard flat on a shorter lease and start afresh in a new home. The scheme integrates financial assistance, in the form of the Fresh Start Housing Grant, with personal responsibility and social support, to facilitate families’ home ownership journey.

Enhancements to Fresh Start Housing Scheme

HDB will enhance the Fresh Start Housing Scheme (“Fresh Start”) to support more public rental households with children in realising their home ownership aspirations. The new measures, which were first announced by Prime Minister Lawrence Wong in his Budget 2025 speech include:

Increasing the Fresh Start Housing Grant from $50,000 to $75,000: Eligible ST families on Fresh Start will receive an upfront disbursement of $60,000 into their CPF Ordinary Account (OA) before key collection. Another $15,000 will be disbursed into their CPF OA in equal tranches over five years after key collection. The revised grant will take effect from the July 2025 BTO exercise.

Extending Fresh Start to FT families with children staying in public rental flats: To benefit more families, the scheme will be extended to allow eligible FT families with children staying in public rental flats to purchase a 2-room Flexi or 3-room Standard flat on a shorter lease[1], which will be more affordable compared to those on 99-year leases. In addition, as first-timers who have not previously received a housing subsidy, these families are eligible for the EHG of up to $120,000. Hence, they will not receive the Fresh Start Housing Grant of $75,000 meant for ST families.

Eligibility conditions for FT households mirror the existing set of eligibility conditions for STs. More details can be found on the HDB InfoWeb. These families will be guided by HDB’s Home ownership Support Team (HST) and receive social support from social workers. FT families who are eligible can apply for Fresh Start from April 2025. Those emplaced on the scheme can book flats under Fresh Start starting from the first BTO exercise in 2026.

Supporting Singaporeans’ Housing Aspirations

The Government is committed to providing homes to meet the diverse housing needs of Singaporeans and supporting their home ownership aspirations at different life stages. We will continue to keep public housing affordable, accessible and inclusive, and to continue supporting every Singaporean’s home ownership aspirations.

Issued By: MND & HDB

Date: 5 March 2025

[1] Flats sold under Fresh Start will continue to have a lease length that covers all owners and their spouses till age 95, and a minimum occupation period of 20 years to provide stability for their children.